hydrogen railways: the road ahead in costs, challenges, and the future of clean transport

The technology is proven. The vision is bold. Germany has shown it works, and India has charted an innovative path through heritage routes. But now comes the moment of truth: Will it actually happen? Can India pull this off? Let’s tackle the hard questions: the economics, the obstacles, the timeline, and what India’s hydrogen railway future means for travellers, taxpayers, and the environment.

In Parts 1 and 2, we explored the global hydrogen train revolution and India’s unique heritage-focused approach. Now comes the crucial question: when will you be able to ride a hydrogen train?

The Financial Reality: A ₹2,000 Crore Question

Indian Railways has committed to deploying 35 hydrogen trains on heritage routes, but the financial implications are substantial. Industry estimates suggest the complete infrastructure, including train conversion, hydrogen production facilities, and refuelling stations, could require ₹1,500-2,500 crore in initial investment.

The retrofit approach chosen by Indian Railways aims to control costs. Rather than importing expensive purpose-built trains like Germany’s Alstom CORADIA iLint, India is converting existing Diesel Electric Multiple Units (DEMUs) with indigenously developed hydrogen fuel cell systems. The Railway Ministry has not disclosed specific per-unit costs, but this strategy could potentially reduce capital expenditure by 40-50% compared to new purchases.

However, the economics extend beyond initial investment. A 2024 ICCT report on India’s electric vehicle incentives highlighted infrastructure costs as a persistent challenge for alternative fuel adoption.

For hydrogen trains, the ongoing expense of green hydrogen production remains uncertain. Currently, green hydrogen costs approximately ₹300-400 per kilogram in India, significantly higher than diesel on an energy-equivalent basis, according to the National Green Hydrogen Mission documentation.

The government projects green hydrogen costs will fall by 60-70% by 2030 as production scales under the ₹19,744 crore National Green Hydrogen Mission. Whether this timeline aligns with railway deployment remains a critical variable.

The Infrastructure Challenge: Building From Zero

India’s hydrogen railway ambitions face a fundamental obstacle: the country currently has minimal hydrogen production and distribution infrastructure. Unlike Germany, which leveraged existing industrial hydrogen networks, India must build this ecosystem essentially from scratch.

The Sonepat-Jind pilot project includes one hydrogen filling station at Sonepat, designed to supply two trains during the six-month trial. Scaling this to support 35 trains across geographically dispersed heritage routes presents logistical complexity. The mountainous terrain of routes like Kalka-Shimla and Darjeeling Himalayan Railway adds transportation challenges for hydrogen delivery.

Railway officials have indicated that localised hydrogen production using renewable energy, particularly hydroelectric power in the Himalayan regions, could address distribution challenges. However, no specific production facilities have been announced or tendered as of early 2025.

Safety infrastructure presents another consideration. Hydrogen’s flammability requires specialised handling protocols, leak detection systems, and emergency response capabilities. Indian Railways has begun training programs, but industry observers note that building comprehensive safety systems across multiple states will require coordinated effort between railways, state governments, and emergency services.

The Timeline: When Will Trains Actually Run?

Railway Minister Ashwini Vaishnaw shared video footage of the hydrogen train in August 2025, suggesting the Sonepat-Jind pilot was nearing operational readiness. Initial reports indicated trials would begin in mid-2025, though no official passenger service launch date has been confirmed.

For heritage routes, the timeline appears more extended. The Research, Design & Standards Organisation (RDSO) is finalising technical specifications for narrow-gauge hydrogen trains. Industry sources suggest commercial deployment could begin by late 2025 or early 2026, though this timeline has been characterised as “ambitious” by railway analysts.

The Himachal Pradesh government has been actively advocating for hydrogen conversion of the Kalka-Shimla Railway, with Chief Minister Sukhvinder Singh Sukhu urging the Centre to prioritise this UNESCO World Heritage route. However, no firm deployment schedule has been announced.

Historical precedent suggests caution regarding timelines. India’s broader railway electrification program, while successful, has consistently run behind initial projections. The hydrogen initiative involves newer, less-proven technology, suggesting schedule flexibility may be necessary.

The Environmental Impact: Real Benefits or Greenwashing?

The environmental case for hydrogen trains depends critically on hydrogen sourcing. If trains run on green hydrogen produced from renewable electricity, emissions reductions are substantial. If they rely on grey hydrogen derived from natural gas, India’s current dominant production method, the climate benefits largely evaporate.

Indian Railways transports approximately 11.5 million passengers daily across its network. However, the initial 35 hydrogen trains represent a tiny fraction of this system. Their environmental impact will be more symbolic than transformative in the near term, serving primarily to demonstrate technology viability and build expertise.

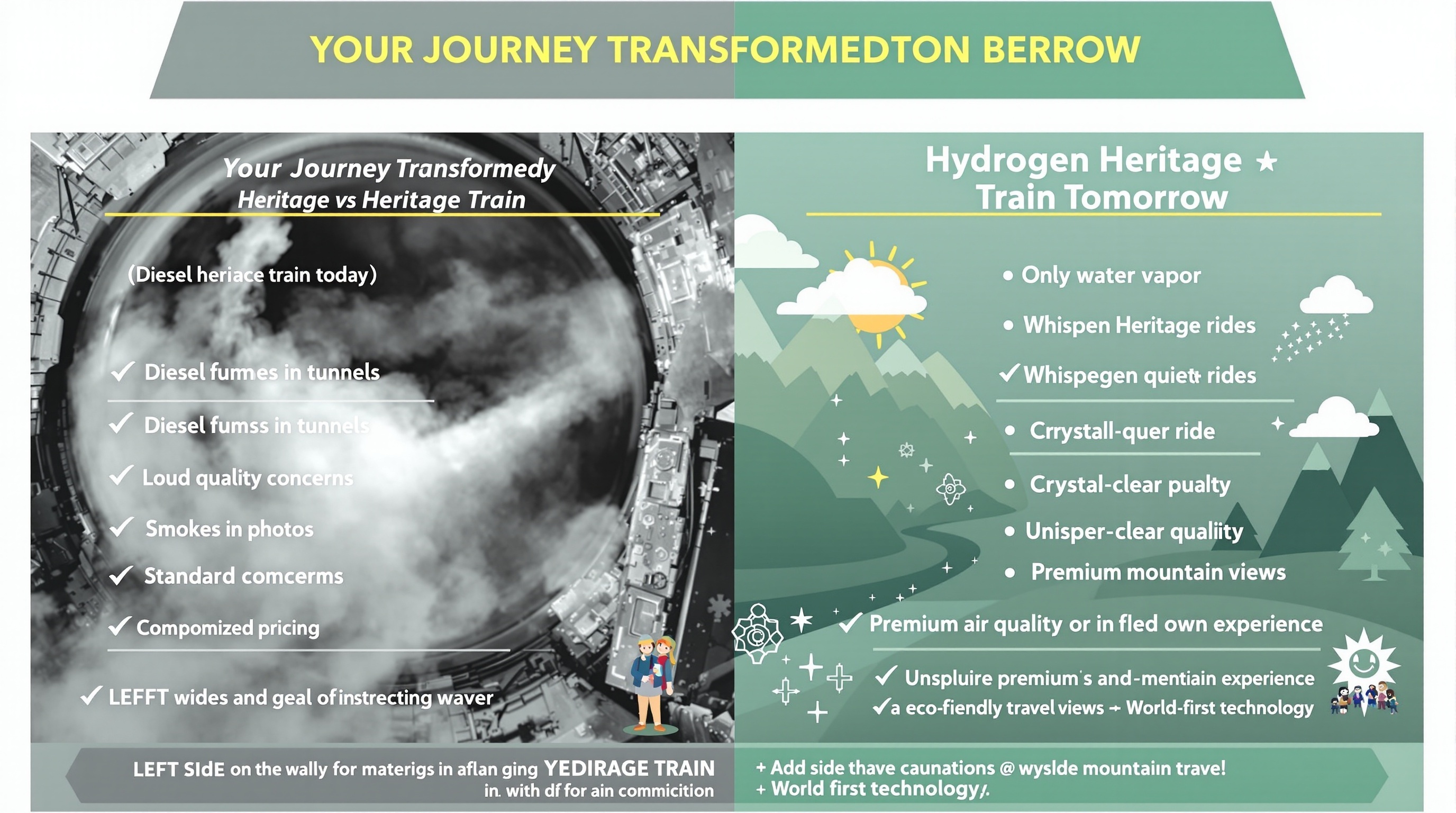

For heritage routes specifically, the benefits are clearer. Eliminating diesel emissions in ecologically sensitive mountain environments like the Shimla hills and Darjeeling tea gardens offers tangible air quality improvements. UNESCO World Heritage designation comes with conservation obligations, and hydrogen trains align with these mandates better than continued diesel operation.

The broader question is scalability. If successful, could hydrogen technology extend to India’s approximately 45% of railway routes that remain non-electrified? The answer depends on green hydrogen costs, infrastructure development, and comparative economics against continuing electrification and battery-electric alternatives.

International Context: Learning From Germany’s Experience

Germany’s experience offers both encouragement and caution. The country operates over 40 hydrogen trains commercially, proving the technology works in real-world service. However, recent reports indicate technical challenges with reliability and maintenance costs higher than initially projected.

A 2025 analysis noted that Germany’s 27-train fleet ordered in 2019 faced delays exceeding three years beyond original schedules. While these are first-generation challenges expected with pioneering technology, they underscore the gap between vision and operational reality.

India’s retrofit approach may avoid some of Germany’s challenges by adapting proven train platforms rather than designing entirely new vehicles. Conversely, it may introduce integration complexities unforeseen in purpose-built designs.

The Verdict: Cautious Optimism With Caveats

India’s hydrogen train initiative represents genuine innovation, particularly the heritage railway focus. The strategic logic is sound: start with high-visibility, lower-scale routes where premium pricing can offset costs while building expertise for broader deployment.

However, significant uncertainties remain. The financial model depends on green hydrogen cost reductions that are projected but not guaranteed. Infrastructure development requires coordination across multiple government levels and private sector participation that has not yet materialised at scale. Technical challenges will inevitably emerge during pilot operations, potentially extending timelines.

For travellers hoping to ride a hydrogen heritage train, 2026-2027 appears realistic for initial services on routes like Kalka-Shimla, assuming the Sonepat-Jind pilot succeeds and infrastructure development proceeds without major delays. Widespread deployment across all 35 planned trains may extend into 2028 or beyond.

The environmental impact will ultimately depend on execution. Hydrogen trains running on green hydrogen represent meaningful progress toward sustainable transportation. Hydrogen trains running on grey hydrogen are essentially diesel with extra steps. India’s commitment to the National Green Hydrogen Mission suggests genuine intent toward the former, but implementation will reveal the reality.

The hydrogen railway revolution in India is not inevitable. But it is possible, and the initial steps being taken suggest serious commitment rather than mere publicity. The next 18-24 months will be decisive in determining whether hydrogen trains become a viable part of India’s transportation future or remain an ambitious experiment that encountered insurmountable practical obstacles.

For now, the tracks are being laid. Whether trains successfully run on them remains to be seen.

This is Part 3 (Final) of a three-part series on hydrogen trains. Read: Part 1: The Global Revolution | Part 2: India’s Heritage Vision

For more stories on sustainable urban mobility and India’s climate initiatives, follow Urban Voices.

This article is based on insights shared at the 18th Urban Mobility India Conference & Exhibition, held in Gurugram. For more stories on sustainable urban mobility and policy analysis, stay tuned to Urban Voices.